Home & Vehicle Commercial Loan EMI Calculator

Table of Content

The canvas for this type of loan is vast encompassing restoration, renovation, repairs, maintenance, beautification etc. to name a few. You can even add new furnishing to your home and do the interior afresh to give your dream house a brand new look. Home extension which becomes a necessity with passage of time. You may be in need of additional space requiring extra rooms.

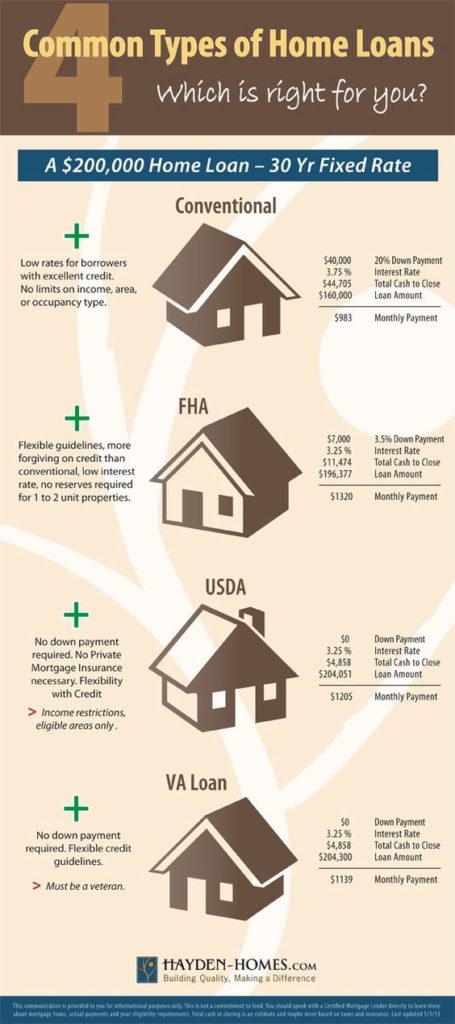

The bank offers floating or variable rate of interest in the home loans in its bouquet. Various Builder/Developer who have advertised their products. Magicbricks is only communicating the offers and not selling or rendering any of those products or services.

Sundaram Home Finance Limited Home Loan

It neither warrants nor is it making any representations with respect to offer made on the site. Self – construction of a residential unit on a pre-owned plot of land. By taking this loan you can buy a piece of choice plot, on which you desire to construct a suitable residence of your own. There are riders attached to this loan, unlike the other loans pertaining to the time frame of construction.

Quick turn over time and better appreciation of customer needs. You can avail a top up loan for a maximum term of 15 years or till your age of retirement, whichever is lower.

Eligibility Criteria for Sundaram BNP Home Loan

SecurityEquitable Mortgage of the property financed by deposit of title deeds. Sundaram BNP Home Finance is a Chennai based JV enterprise between a NBFC Sundaram Finance Limited and BNP Paribas Personal Finance with a strong focus, primarily in South India. Presently they are aiming to expand their existing areas of operations with a network of 100 branches spread across the country. Trusted for generations, our deposit plans help your savings grow consistently for a prosperous and happy future - at promising interest rates. Discover our competitive interest rates, tenure and more today. There are a number of ways by which you can apply for a suitable home loan.

Sundaram Home Finance offers attractive interest rates to those with a good credit score. Since there is no premium housing loan, the normal admissibility of the quantum is to be reckoned. However, it needs mention that there is no prescribed higher limit of home loan. Eligibility Criteria for Sundaram BNP Home Loan for Resident IndiansIndividualsBoth salaried and self employed professionalsPurposeConstruction of house on your own plot of land.

Key features of Sundaram Home Finance Home Loan

NRI customers are discerning by nature earning their income in hard currency. This is advantageous to you as well as the bank, as the conversion fetches handsome dividends. Therefore, all the facilities of the home loans offered to the resident Indians are also extended to the NRIs to cater to their need of home ownership. Most NRIs view this as an investment opportunity, serving multiple goals. Firstly they create an asset, the value of which is bound to appreciate in future considering the trends. Secondly, they are able to provide decent accommodation to their parents or close blood relations as a social necessity.

When you desire to live a life without limits, a top up on your loan amount is just what you need! At Sundaram Home, we offer you a Top Up Loan on your existing Home Loan which could help meet your personal commitments, holidays, gifts or any contingencies. The documentation required to apply for Sundaram Home Finance home loan is minimal. You must remember that the list of documents cover majority of the requirements, but the bank may seek additional documents as and when necessary. Home improvement is another purpose commonly approached by you through a home loan.

Home Loan Bank Information

Current overseas residential proof such as house lease agreement, bank statement, utility bill, card statement, etc. You can apply for a top up loan after 12 months' of the final disbursement of your existing home loan and upon possession / completion of the existing financed property. It is already discussed that there are no special differences in the housing loan for resident Indian and the NRI. The major difference if any lies in the loan tenor which is restricted to 15 years in the case of NRI. Needless to mention, the NRIs are entitled to seek all types of home loan solutions in their bouquet. According the following grid highlights only the differences, keeping the matching eligibility norms aside.

Thirdly, it acts as a backup for later years, if they repatriate and spend their retired life here. @If the parent deed is prior 13 years and covers the same extent of property owned by the vendor, then the EC from the date of the said Original purchase/acquiring the property is required. @ If the parent deed is prior 13 years covers the same extent of property currently owned then the EC from the date of the said Original purchase/acquiring of the property is required. Having come this far, it is now time to recapitulate the various features discussed so far and the cost of capital feature, especially the interest on the loan amount. The home loans they offer are all term loans with variable floating rate of interest. Sundaram BNP home loans are eminently suited to variety of purposes and covers vast cross section of society.

Magicbricks is a full stack service provider for all real estate needs, with 15+ services including home loans, pay rent, packers and movers, legal assistance, property valuation, and expert advice. As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. Among the host of facilities for them, they also offer housing loans.

It is geography centric depending on the country of residence. In lay man’s terms one can safely surmise that an individual with abundant liquid assets at his disposal is deemed to be high-net-worth individual. It is beyond doubt to infer that the individual is likely to propose high cost projects. It will definitely impact Sundaram BNP home loan portfolio without the perils of default.

Comments

Post a Comment